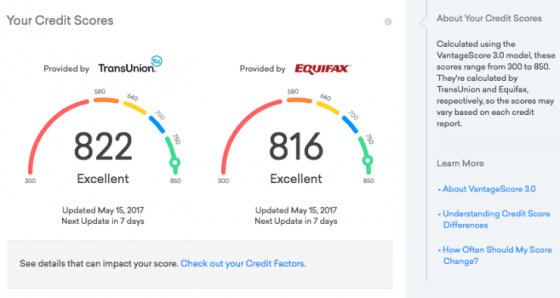

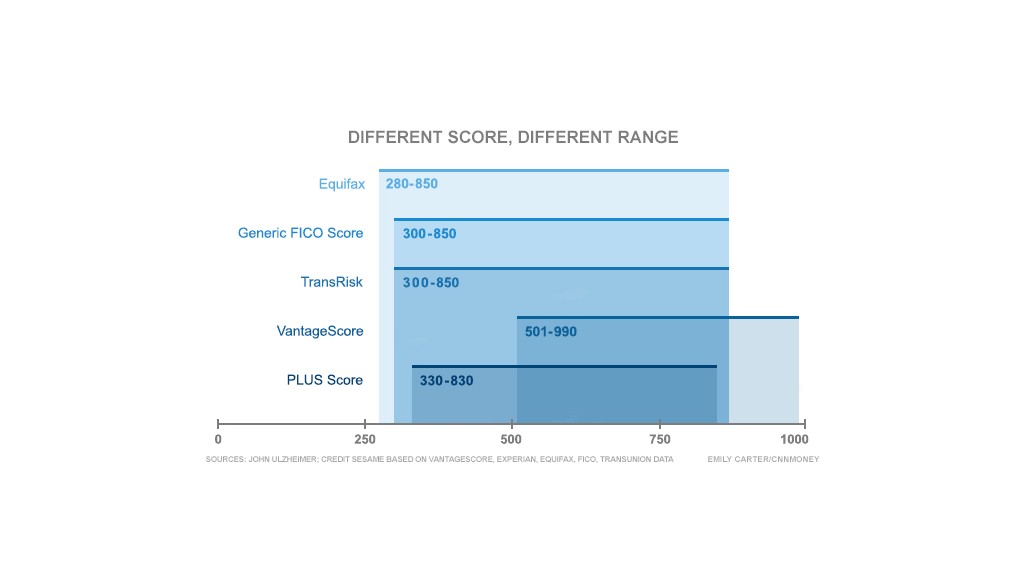

Still, credit scores are imperfect predictors, likely because most credit models assume that consumers will continue to act in the same way in the future as they have in the past. In this way, lenders can maximize the number of loans they make. Credit scores really began to exert an influence on American borrowers beginning in the 1980s as FICO become widely used.Ī major goal of the credit score is to expand the pool of potential borrowers while minimizing the overall default rate of the pool. The FICO credit scoring system was enhanced over the 1960s and ‘70s, and lenders grew to trust computerized credit evaluation systems. Before then, bankers relied on commercial credit reporting, the same system merchants used to evaluate the creditworthiness of potential customers based on relationships and subjective evaluation. Credit score evolution from the 1980s to the 2020sĭeveloped in the late 1950s, the first credit scores – FICO scores – were created to build a computerized, objective measure to help lenders make lending decisions. These trends might, in part, reflect new programs that are designed to note when individuals pay bills like rent and utilities on time, which can help boost scores.ĭuring the first quarter of 2023, people taking out new mortgages had an average credit score of 765, which is one point lower than a year ago but still higher than the pre-pandemic average of 760. Six in 10 Americans have a score above 700, consistent with the general trend of record-setting credit scores of the past few years. consumers had scores considered very good – meaning in the range of 740 to 799 – or excellent (800-850). A credit score ranging from 670 to 739 is generally considered to be good, a score in the range of 580 to 669 would be judged fair, and a score less than 579 is classified poor, or subprime.Īs of 2021, nearly half of U.S. Based on that repayment behavior, the credit scoring system assigns people a single number ranging from 300 to 850. However, some people still have no credit later in life if they don’t have any accounts for reporting agencies to assess.Ĭredit scores simply summarize how well individuals repay debt over time. Most people don’t have a credit score before turning 18, which is usually the age applicants can begin opening credit cards in their own name. are Transunion, Experian and Equifax.Īlthough 26 million of 258 million credit-eligible Americans lack a credit score, anyone who has ever opened a credit card or other credit account, like a loan, has one.

The three organizations that monitor credit scores in the U.S. So how do lenders distinguish between good borrowers and risky ones? They rely on various proprietary credit scoring systems that use past borrower repayment history and other factors to predict the likelihood of future repayment. Lenders have a strong business incentive to separate loans that will be paid back from loans that might be paid back. Some borrowers consistently make prompt payments, while others are slow to repay, and still others default – meaning they do not pay back the money they borrowed.

Lenders stay in business when borrowers pay back loans.

Credit scoring assesses the likelihood of default

0 kommentar(er)

0 kommentar(er)